According to a recent study by MTI Consulting (who are also currently studying the feasibility of it), crowd funding has the potential to propel the next generation Sri Lankan entrepreneurs into the global market, while also helping conventional industries and entrepreneurs to seek new vistas.

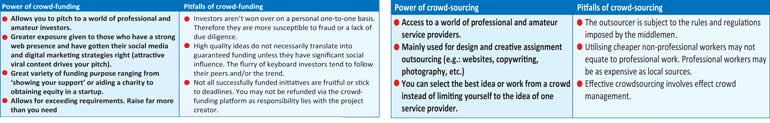

Crowd funding is the process of attracting small amounts of capital from a large number of individuals to finance a new business venture ranging from product and service launches to movie development and travel sponsorships. However, as fledging industry, caution needs to be exercised – in a domain where regulation is still very fluid. Crowd-sourcing: As opposed to using internal employees or established services, crowdsourcing allows tapping into cloud labour and obtaining services, ideas or content on a more competitive basis.

Emerging trends

- In 2013, crowdfunding platforms raised billions of dollars – $ 5.1 billion, to be exact – a third of which went to social causes

- The Crowdfunding Campaign to Save Greece Raised 23,000 Every Hour – Bloomberg Business

- Crowdfunding used as an add-on to maker-movement marketplaces – Esty

- Crowdfunding is one method for raising money, but that’s not its most important feature: What’s really valuable is the market feedback you’ll get because people will be voting for your product with real money.

- It has been difficult to test a new hardware product before it was fully developed and already in the process of being manufactured in volume: Crowdfunding has changed that because now you can sell your product before you have to fully develop it.

- Crowdfunding used as a tool in product development: i.e., measure market readiness, involve others in the design and development process, capture customer response and feedback, use complaints to improve your product, promote and benchmark your final product, engage your market and audience.

- Smartphones will take crowdfunding mainstream.

- Investment clubs will move online: Investment clubs and angel groups will move their operations online. Investors will leverage personal connections to create online syndicates for startup investments, forming not just social circles but rather new investment circles.

- Ability for non-accredited investors to buy shares in high flying startups through equity crowdfunding platforms.

- Platforms will offer mutual fund type instruments for amateur investors.

- Banks and financial institutions, will partner with equity based crowdfunding platforms to offer their clients exposure to early stage ventures (startup portfolio part of the overall managed account).

- Secondary market offerings will allow liquidity.

- Specialisation and differentiation will take place – platform will establish its own specialisation, focusing on a specific vertical, company lifecycle stage or geography.

MTI Consulting is an internationally-networked boutique management consultancy, offering advisory services in Strategy, Strategic Planning, Corporate Re-structuring, Process Re-engineering, Performance Management, International Market Entry, Feasibility Studies, Due Diligence, Corporate Finance, M&A, HR, Executive Search / Head Hunting, Marketing Strategy, Branding and Market Research.

Since the inception in 1997, MTI has worked on over 520 assignments in over 43 countries, covering a diverse range of industries, clients and business challenges.