As part of the 2018 Investment Outlook Series, MTI Corporate Finance carried out a study of currency alternatives to the USD as trade war fears linger among investors.

Explaining the rationale for the study, MTI’s Corporate Finance Consultant Naush Beg said “Globally we have observed a selloff in equity markets as investors grapple with the possibility of a global trade war on the back of the US implementing tariffs on its major trade partners. On this background, we see a likely upside to certain currencies (alternative to the USD) which may provide investors with an interesting opportunity in this volatile situation”.

While a range of factors affect currency performance, the MTI Corporate Finance study evaluated a basket of currencies based on criteria such as interest rates, inflation rates, trade indicators such as terms of trade and balance of payments, government debt and trade volume with the US in carrying out this study.

Japanese Yen

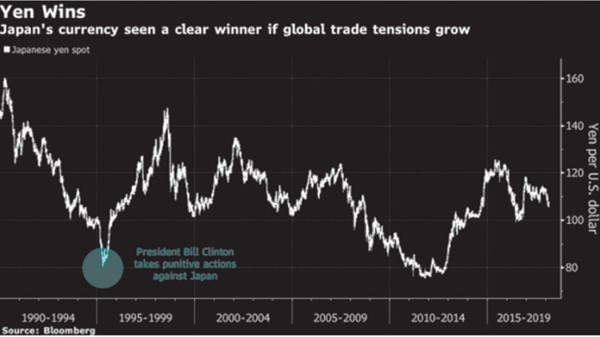

The Japanse Yen has long been favoured by investors as a safe haven currency during volatile times triggered by trade and political developments. Historically, the Yen has rallied with US treasuries as investor risk appetite declines in the market.

As a testament to this, the yen surged to a record high in 1995 when the US took punitive actions against Japan and has shown similar performances during the global financial crisis and Brexit. More recently, in light of the US announcing tariffs on steel products, the Yen rallied to its highest level since 2016.

The Yen’s resilient performance has been supported by the heavily indebted nation’s continuously recurring current account surplus; a trend that is likely to continue as the country’s exports surge on the back of stronger global trade and demand from China. Notably, Japan posted its 10 year highest current account surplus in 2017 on account of a tourism boom and increased income from foreign investments.

The currency may also be supported by the country’s record low inflation levels which remain below 2% levels. However, on this background the Bank of Japan will pursue an expansionary monetary policy onto 2019 which may be threaten the currency’s appreciation.

Swiss Franc

The Swiss Franc also stands next to the Japanese Yen as a safe haven currency as indicated during the global financial crisis and more popularly the European debt crisis in 2011.

Like Japan, Switzerland has also been maintaining a steady current account surplus making it a net exporter nation. This has made the US, the country’s 2nd biggest trading partner, to accuse Switzerland of keeping the Franc under artificially low levels. This may prompt the Swiss National Bank to keep the currency strong, an upside to traders bullish on the Franc.

However the country is home to record low interest rates, a trend that will continue as the Swiss National Bank announced in March 2018 to keep monetary policy unchanged for the 13th quarter in a row. This may act as a deterrent to the currency’s appreciation.

Australian Dollar

Australia is one of the few countries that was exempted from US tariffs on steel. According to Bloomberg, it is also viewed as a replacement for US goods among Chinese buyers, an advantage that may further be enhanced with the newly signed Trans Pacific Partnership which now excludes the US. Notably, analysts also see higher demand of iron ore, Australia’s largest export, from its biggest consumer China which may again support the currency.

In addition, Australia’s overall trade position paints a healthy picture with an improving trade surplus and strengthening terms of trade.

However on the flipside, the Reserve Bank of Australia kept its policy rates on hold at record low levels with no indication of tightening.

Chinese Renminbi

China is the 2nd biggest trading partner of the US with the US having its biggest trade deficit with China; the main cause of the sudden implementation of tariffs from the Trump administration. However, despite the direct trade barriers, the Renminbi has been on an appreciating trend as investors see signs of China smoothing trade tensions with the US.

China also strives to make the Renminbi a global mainstream currency, a feat that it may achieve as evidenced by the Renminbi’s inclusion in the IMF’s SDR basket of currencies. Recently, China launched Renminbi denominated crude futures contracts to step up the currency’s internationalization. All these may add to the strengthening of the currency.

In addition, the country’s central bank raised money market rates in end December 2017 in line with the Fed rate hike, further supporting the currency.

However, on a negative front, the currency has a strong negative correlation of almost -0.6 with its exports which may prevent authorities from supporting currency appreciation to safeguard its trade position.

Malaysian Ringitt

According to the Bank of International Settlements, the Ringitt has been the best performing Asian currency in 2018 so far. Notably, the currency gave the 2nd highest return among emerging markets in 2017, second only to the South Korean won.

Bank Negara increased interest rates in January 2018 for the first time since 2014, giving the currency a boost and leading the bank to keep rates unchanged in March as inflation rates continue to stay at low levels.

However, just like China, the Malaysian Ringitt has a strong negative correlation near -0.6 with exports, hence authorities may likely curb the currency’s gain to limit the fall of the country’s export competitiveness.

In Summary:

- The Japanese Yen and Swiss Franc are considered safe havens during trade and political turmoil

- The Australian Dollar may stand to benefit from US tariffs

- The Chinese Renminbi’s increasing global importance may strengthen the currency

- The Malaysian Ringitt has been one of the best performing emerging market currencies in 2018 so far

However as with any investment vehicle, key risks remain:

- Further advancements in protectionist trade policies by the Trump administration, may negatively affect the trade position of countries and weaken their respective currencies against the greenback.

- Economic factors in China which may subdue demand as well as possible trade restrictions from the US may dampen trade activities of countries with a large trade exposure to China.

- Emerging market economies are sensitive to political factors which may affect key policy rate decisions.

- Shift in regional dynamics through changing trade relations. For instance, China’s one belt, one road initiative is likely to open new markets to China’s economy.

- Lack of transparency and ad hoc policy changes by central banks and other governing bodies result in unexpected movements in currency.

- Looking for short term gains can be very risky as currency changes occur very fast requiring excessive monitoring.

- Currencies as a whole are affected by many variables, some of which cannot be pin pointed or forecasted. Even a very comprehensive analysis by a brilliant analyst may not be able to determine the movement in a currency.

Readers should not consider this article as a recommendation of any sort. This is merely an evaluation of currencies MTI Corporate Finance has undertaken for information purposes.

Sources: Bloomberg, xe.com, asia.nikkei, Reuters, marketwatch, financialsense.com

Photos: Naush Beg heads MTI’s Regional Investment Banking Team and Dr. Jason Cordier leads MTI’s International Research Team